CSFi Releases G4-Web Maker-Checker Module

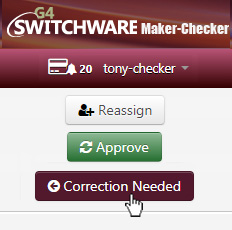

The SWITCHWARE® G4-Web Maker-Checker add-on permits one person to make card record changes in the G4-web customer card management (CCM) client application and a second person to approve the change. It enhances the … Read more