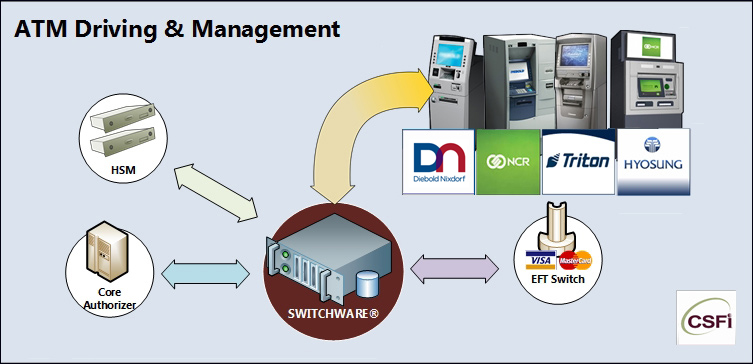

Solution Overview

This solution is meant for financial institutions who wish to maintain control over their ATM network processing and reap the cost benefits of driving their own ATMs in-house. The primary purpose of CSFi’s SWITCHWARE® solution is to perform transaction processing and routing decisions that include sending at-us, on-us transactions to your core system for authorization, sending foreign transactions to shared EFT networks, performing PIN validation and standing in when the core system is unavailable.

ATM Management Benefits

ATM Management Features

- Eliminate at-us, on-us fees

- Generate additional fee income

- In-house autonomy and control

- Personalized card functions

- Cross selling of services at the ATM

- Improved customer dispute resolution

- Faster speed to market

- Enhanced CSR knowledge

- Improved customer support services

- ATM terminal driving and management

- Remote Key Loading

- Core system interface

- EFT network interface

- Stand-in authorization

- ATM/EFT network monitoring

- Automated alert notification

- Management information reporting

- and much more …

Deposit Automation

The leveraging capabilities of ATM deposit automation and cash recycling are quickly becoming required components of remote delivery strategy. As cost conscious financial institutions reshape their branches towards a sale and service business model rather than a transactions processing model, the drive to enhance self-service and remote delivery capabilities has risen to the forefront, while the need for the performance of many traditional “in branch” tasks has diminished…. Read More.

Supported ATM Brands

- Diebold Wincor/Nixdorf (Vista & D91X)

- Fujitsu

- GenMega (Triton Emulation)

- GRG

- Nautilus Hyosung

- NCR (Activate Enterprise & Advanced Aptra NDC)

- Triton

Remote Key Loading (RKL)

ATMs rely on network protection and encryption keys to keep customer data and ATM funds safe. To reduce the risks of key compromise, individual countries, major networks and card associations enforce strict guidelines for key management including assignment of unique and random master keys for each ATM. These encryption keys must be changed on a regular basis in order to meet compliance mandates and maintain security…. Read More.

ATM Messages to Cardholders

Messages to cardholders at the ATM is just one of SWITCHWARE®s integrated functionalities designed to attract and retain customers, increase cardholder usage, and make the most of every visit to an ATM terminal. Every customer contact is critical to business success, and the customer experience at the ATM is no exception. ATM screens represent prime branding and advertising real estate, and provide an opportunity to both strengthen customer relationships and promote high value bank services and products.

The messages to cardholders at the ATM enable institutions to optimize the ATM channel as a targeted marketing, sales and branding tool. From simple birthday greetings to targeted advertising messages, this feature will provide “on demand” remote customization of personalized content, taking full control of the cardholder’s ATM experience. The highly intuitive cardholder messaging interface streamlines the process of ATM message administration and management, making it easy to take full advantage SWITCHWARE’s cardholder messaging functionality.

Global or cardholder specific messaging can be displayed at any time, on the “splash” or “welcome” screen or at any other time during the transaction authorization process.

Some of the message types currently supported include:

- Marketing messages– promoting new products or services

- Personalized messages– holiday greetings or other acknowledgments

- Notification messages- global or customer specific alerts

- Expiration messages- upcoming card expiration

- Birthday messages– special birthday greetings for your customers

ATM Messages to Cardholder Benefits

- Optimizes ATM role as a key delivery channel

- Personalizes and strengthens customer relationships

- Enables targeted marketing of high value bank products and services

- Allows targeted delivery customer alerts and notifications

- Highly intuitive interface enables easy implementation of full messaging functionality

- Increased revenue potential resulting from enhanced messaging functionalities