ATM/Debit Payment Authorization and Transaction Switching System

Solution Overview

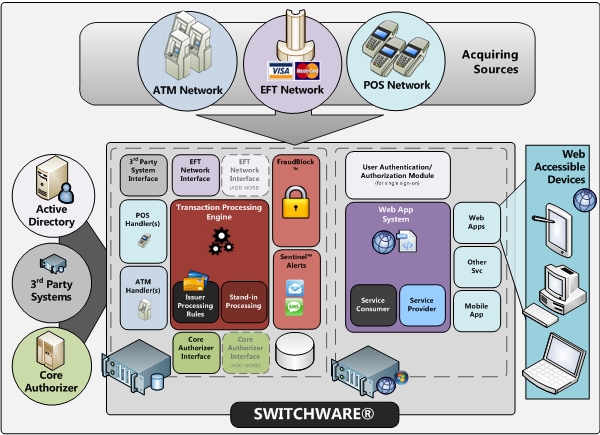

SWITCHWARE® is an enterprise payment authorization and transaction switching system, used primarily for EMV ATM/debit card issuing, card-based transaction processing and ATM/POS acquiring device management. SWITCHWARE serves as a robust and reliable solution for financial institutions who wish to minimize costs by internally managing “in-house” the ATM and POS device operations, the EMV ATM/debit card issuance, and card transaction routing and processing between an electronic funds transfer (EFT) network and a core banking or host authorizing system. SWITCHWARE has several features and layers of redundancy that improve performance and enhanced data security.

Latest Enhancements

The latest release represents a major milestone for SWITCHWARE as it incorporates greater cardholder security measures in complying with the latest PCI-DSS and added functions including card alerts, enhanced limits, linked-account limits, and much more.

- PCI S3 and PA-DSS 3.2 Compliant

- Cardholder Alerts

- Activate/Deactivate Entire BIN

- SSL/TLS Encryption

- Enhanced Auto Stand-in Processing

- TMD ATM Anti-Skimming Support

- Currency & Denomination Selection at the ATM

- API for Card Enable/Disable Feature

- New GL Account for Deposits at Each ATM

- Additional Cardholder Limits

- Linked-Account Limits

- Triton ATM EJ & EMV Support

- Contactless EMV Support

- Mobile Wallet Enrollment Support

- Low-Note Threshold Options by Cassette

- Foreign Cardholder Limit Feature

- Certification for Diebold Vista Stateless Program

Highlighted SWITCHWARE Functions

SWITCHWARE is a multi-threaded high performance system designed to drive connected ATM and acquire POS device transactions. Current implementations of SWITCHWARE drive as few as ten ATMs to others driving a thousand or more, each implementing a single instance of SWITCHWARE.

- Comprehensive ATM Driving Solution

- POS & MPOS Terminal Acquiring

- ATM Debit Issuing, Acquiring and Processing

- Connect Unlimited EFT Networks/Processors

- Connect Unlimited Core Authorizing Systems

- Web Browser Accessible via G4 Web-apps

- Full Auditing and Logging Capable

- Color-coded Icon-based display

- Single System Card Issuing Module

- Multiple Open-Account Relationships

- Multiple BINs and Institutions

- Instant Card Issuance Support

- Automated Job/Task Scheduling

- Email/Text Alert Notification

- Install on physical server or virtual machine

- Multiple Institution Support

- Multi-Language Support

- Connect Unlimited Third-Party Systems

- POS & MPOS Merchant Mgmt

- Real-time ATM Monitoring

- Graphical Device Display

- Inactivity Alerts

- Interactive Teller Machine (ITM) Support

- Cardless Withdrawal Support

- Integrated Realtime Fraud Protection

- High Availability and Recovery Options

- Single Sign-on with Active Directory

- Easy Setup and Monitoring of Connections

- Full Cardholder and Transaction Research

Additional SWITCHWARE Features and Functions

- RSA remote key loading

- Stand-in authorization

- Rules-based transaction processing

- PA-DSS validated for PCI compliance

- Debit/prepaid issuing & authorizing

- ATM program management

- ATM fee management

- ATM messaging to cardholder

- Electronic journal

- P2P Cardless Withdrawal/deposits

- Cash Recycling support

- Interactive Teller Machine (ITM) support

- EMV chipcard issuing and acquiring

- Flexible parameterized design

- Scalable transaction engine

- Reconciliation subsystem

- Triple DES support

- Multi-vendor HSM support

- Reporting module for research, settlement, and dispute resolution

- Deposit automation

- Multi-Currency Support

- ATM personalization support

- Manage cardholder limits

- Limit or deny foreign cardholders

- Limit overseas cardholder use

- Multi-institution support

- Database encryption4

- Multi Language support

- On-demand Network Denial Rules New!

- Coupon & stamp dispensing

- Mobile top-up

- Bill payment

- Multiple EFT connections

- Multiple host connections

- Visa and MasterCard Worldwide

- Connection to third party apps

- Unix/Linux-based server

- High availability support

- Card embossing file support

- Online card maintenance (OLCM) support

- Full client auditing

System Integration & Setup

CSFi provides project coordination, system setup, training, and remote live conversion assistance. In addition to the system parametrization and setup, CSFi also assists customers with certifying the ATM/EFT network, including transaction processing and sending the card maintenance batch file.